August 01, 2013

As the State of Illinois enters the fifth year of its $31-billion Illinois Jobs Now! capital spending program, revenue sources approved to fund the projects are still lagging far behind original projections.

Revenues deposited in the Capital Projects Fund in FY2013 from dedicated taxes and increased fees approved by the General Assembly in FY2010 are between $300 million and $500 million short of the original expectations. The funding is needed to pay for anticipated debt service on more than $16.0 billion in bond-funded projects included in the capital budget. The revenue sources approved as part of the capital program included taxing legalized video poker; leasing the management and online operations of the State lottery; expanding the sales tax to include soft drinks, candy and some personal care products; increased liquor taxes; and increased vehicle registration and title fees.

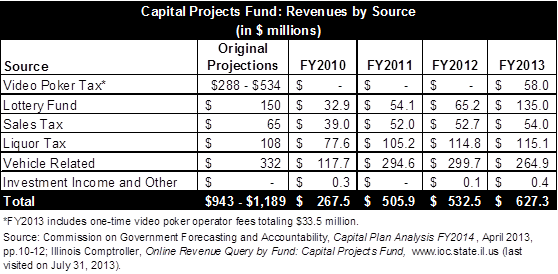

Online records from the Illinois Comptroller’s Office show a total of $627.3 million in capital revenues in FY2013. This is up from $532.5 million in FY2012 but still well short of the legislative projections of $943 million and $1.2 billion, which were widely circulated when the original spending was approved in FY2010.

The following table shows the revenues deposited into the Capital Projects Fund from FY2010 through FY2013 compared to the original projections for each revenue source.

The largest shortfall in revenues is related to the delay in implementing and taxing the newly legalized video gaming, which was the largest single source of revenues in the approved funding package. As discussed here, it took the State much longer to administer licenses and roll out the State-wide system to monitor video gaming than originally predicted. The first machines were not put into service until October of last year. FY2013 marks the first year that any revenue was generated from the 30% tax on video gaming in the State, of which five-sixths is used for capital project funding and the remainder given to local governments to pay for adverse social effects of gaming. However, the total of $58.0 million in FY2013 video gaming revenues is well below the projections of $288 million to $534 million annually. The initial revenues also include one-time operator fees totaling $33.5 million, making the total recurring revenue only $24.5 million.

Even after video gaming is fully implemented, total revenues generated for the State construction program will likely only reach between $106 million and $196 million annually, according to a report on the capital program from the Commission on Government Forecasting and Accountability (COGFA). The COGFA report states that 63.3% of the Illinois population lives in communities where video gaming is illegal. This includes communities like Chicago, which represents 21.0% of the State population, where existing bans would have to be lifted to allow video gaming, as well as other communities that passed resolutions preventing expansion of video gaming after the law was passed.

Although gaming revenue has accounted for the largest shortfall in capital funding, only the increased liquor tax has met expectations while all other sources continue to fall short.

Meanwhile, the legislature reapproved an estimated $21.4 billion in capital appropriations for FY2014, which remain unspent from the original $31-billion Illinois Jobs Now! program. The more than 1,300 page bill received a single line item veto from Governor Pat Quinn, to correct a redundant line item that had been approved in another bill.

According to COGFA, the FY2014 capital budget includes $9.4 billion in bond-funded projects originally approved in FY2010 as part of Illinois Jobs Now! that are still waiting for funding. The remainder represents the State’s ongoing road program, federally funded projects and locally funded projects. Although the Governor proposed an additional $3.3 billion in new projects for FY2014, it is unclear if the General Assembly approved any of those items. As discussed here, the lack of transparency in the capital budget and absence of a comprehensive capital improvement plan limit the public’s ability to track when projects start or are completed, final costs or when new projects are added to the budget.